Strong Rebound of US B2B Exhibition Industry Continues

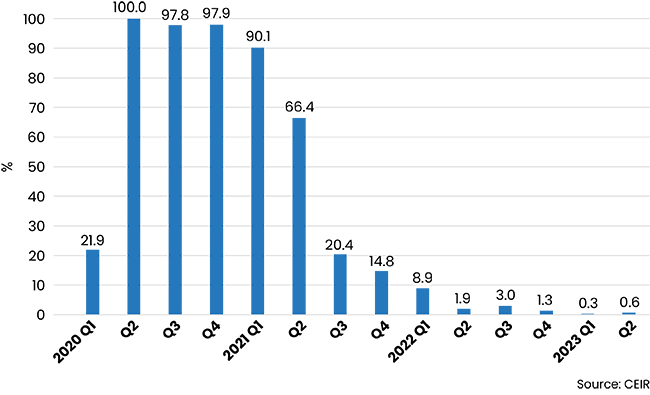

DALLAS, 5 September 2023 – The Center for Exhibition Industry Research (CEIR) announced today that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording a continued though choppy improvement in Q2 2023 from the previous 13 quarters. The cancellation rate for physical in-person events remained extremely low at 0.6%, which is a dramatic improvement from 66.4% in Q2 2021 and 1.9%% in Q2 2022.

Figure 1: B2B Exhibition Industry Cancellation Rate, %

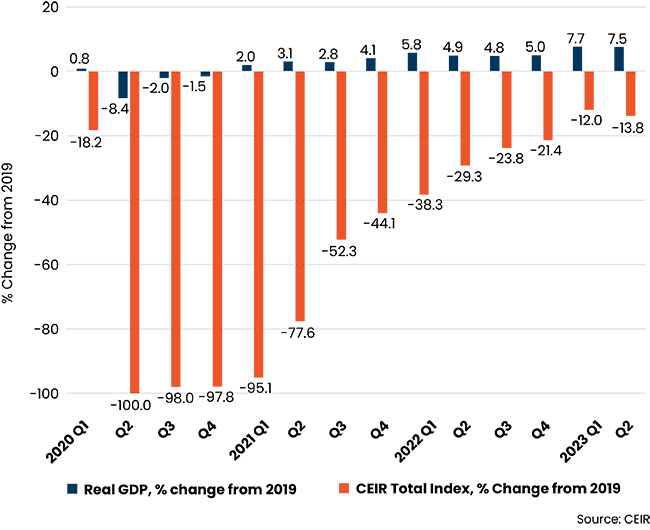

Extremely low cancellations and continued improvement in metrics outcomes for completed events boosted the Q2 2023 Index result. As expected, the CEIR Total Index – a measure of overall exhibition performance – continues to recover, surging 21.8% from a year ago. Compared to Q2 2019, it was still 13.8% lower (Figure 2) which is a vast improvement compared to the past two years, which included declines of 77.6% from 2019 in Q2 2021 and 29.3% from 2019 in Q2 2022. Nonetheless, compared to Q1 2023, Q2 CEIR Total Index was lower by 1.8 percentage points.

US GDP and the CEIR Total Index

The performance of the U.S. economy was far better, registering a 7.6% increase in real (inflation-adjusted) GDP from Q2 2019 to Q2 2023. On a seasonally-adjusted annual rate (SAAR) basis, real GDP rose at a modest rate, gaining 2.1% in Q2 2023. The continued rebound in Q2 primarily reflected increases in consumer spending, nonresidential fixed investment and government spending at all levels and that were partly offset by decreases in exports, residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Up to Q4 2021, economic recovery had been led by strong spending on goods. However, the initially sluggish recovery in services industries recently has picked up the pace. In Q3 2021, real spending on consumer services finally recovered pandemic losses and robust expansion has continued since then. In Q2 2023, real spending on consumer services exceeded Q4 2019 spending levels by 5.4%, which bodes well for consumer services related exhibitions.

Figure 2: Real GDP vs. CEIR Total Index, Q1 2020-Q2 2023, % Change from 2019

Q2 2023 Exhibition Industry Performance – Recovery Momentum Continues

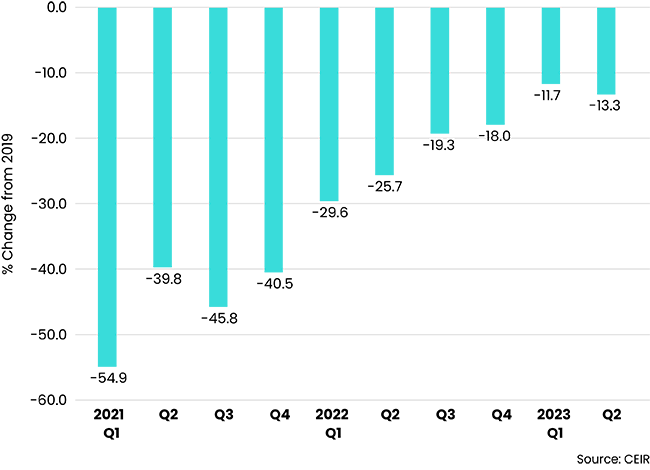

Figure 3 provides insights about events completed during Q1 2021 to Q2 2023, comparing performance of each to the same quarter in 2019. Q2 2023 results speak to a continuing but choppy and uneven recovery that is underway with the overall Index and specific metrics that generally have been improving for the past nine quarters. Among completed events, 22.9% have surpassed their pre-pandemic levels of the CEIR Total Index. This is almost double the percentage of completed events that surpassed pre-pandemic levels in Q2 2022, where 11.7% of events held in that quarter surpassed 2019 results. Some organizers launched new shows, expanded existing shows to new locations or held them at a different time of the year. When looking at results excluding cancellations, performance of events that happened in Q2 2023 documents continued improvement; it is down only 13.3% compared to 2019 (Figure 3), which is much better than the decline of 25.7% registered in Q2 2022 compared to 2019.

Figure 3: CEIR Total Index Excluding Cancellations, % Change from 2019

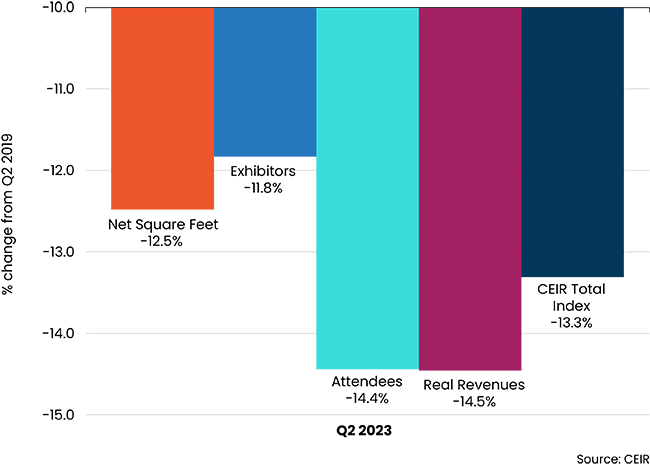

Among the four metrics, Exhibitors has recovered the most, just 11.8% below results registered in Q2 2019; followed by Net Square Feet (NSF) with a decline of 12.5%. Attendees and Real Revenues were about the same level below Q2 2019, with declines of 14.4% and 14.5%, respectively. Low nominal revenue levels and high inflation eroded the value of exhibition income.

Figure 4: Q2 2023 CEIR Metrics for the Overall Exhibition Industry Excluding Cancellations, % Change from Q2 2019

Insights on a Recession

The turmoil among U.S. regional banks is not having as much of an impact on economic activities as analysts feared in March. Recent economic indicators such as consumer spending, payroll employment and the job openings to unemployed ratio indicate that the economy has been resilient and Q3 real GDP growth may rise further. The long-awaited recession is still nowhere in sight. Nonetheless, the impact of monetary tightening on the economy tends to have a long lag, and deep inversion of interest rates, as seen since last autumn, often precedes recession. With one more interest rate hike (25 basis points each) expected, economic growth could fall during Q4 and early next year.

The probability of a recession starting in next 12 months is now lower, standing at 45%-50%. The potential causes of recession include tighter financial and credit conditions, a self-fulfilling prophecy, and some unknown and unpredictable shocks. Businesses that anticipate a recession ahead are cutting back their expenses and head counts. However, if there is recession, it likely will be short and shallow as household debt service payments as a percent of disposable income remain low even though they have inched up recently, there is pent-up consumer demand for services such as travel and tourism, most large corporations still are flush with cash, and there is a race to adopt new technologies such as AI (artificial intelligence) and EV (electric vehicles).

B2B Exhibitions Recovery

Q4 2023 through the first half of 2024 will be challenging for the exhibition industry as the economy slows down and businesses are more cautious. Nonetheless, “the positive momentum of participation in face-to-face trade shows will continue. Widespread B2B exhibition cancellation due to COVID is a thing of the past. Normalization of the exhibition schedule back to pre-pandemic timing and the performance of completed events will continue to improve,” said CEIR Economist Dr. Allen Shaw, Chief Economist for Global Economic Consulting Associates, Inc. “Greater numbers of foreign participants will support additional recovery of volume of attendance and exhibitors. A full recovery for the industry is expected in 2024.” Among 14 industry sectors that CEIR monitors, Transportation and Industrial/Heavy Machinery and Finished Business Inputs sectors are expected to perform better in 2024 and 2025, whereas the Consumer Goods and Retail Trade Retail and Education will lag behind the overall exhibition industry.

“CEIR research has documented an intent to return to face-to-face engagement at B2B exhibitions, and CEIR Index quarterly results continue to document the recovery is in progress,” added CEIR CEO Cathy Breden, CMP-F, CAE, CEM. “Each quarter, the Index is showing that more business professionals and exhibitors are coming back to the B2B exhibitions channel to meet their marketing, sales and business information needs.”

CEIR has released the 2023 CEIR Index Report, which analyzes the 2022 exhibition industry performance and provides an economic and exhibition industry outlook for the next three years. CEIR collects data directly from B2B exhibition organizers, who are encouraged to provide their show data by using the Event Performance Analyzer. In exchange for submitting data for a valid B2B exhibition, the participants are provided this tool which enables an organizer to instantly see how an event’s performance compares to CEIR Index benchmarks at no cost. Data submission is strictly confidential. Click here for more information. The annual CEIR Index Report for their shows’ market sector will also be provided to participating organizers at no cost.

Explanation and Definitions of Q2 Comparisons

As explained above, 1.9% of trade shows scheduled to be held in Q2 2022 were cancelled, limiting the usefulness of comparisons of Q2 2022 and Q2 2023 results, as any positive change would be very large and misleading. A more useful comparison is to the 2019 performance results, measured as the industry benchmark before COVID-19 forced the shutdown. Thus, events in Q2 2023 are compared with those in Q2 of 2019 in Figures 2-4. The CEIR Total Index in Figure 2 is a weighted average that includes both cancelled events, with zero values for all exhibition metrics, and completed events. The Total Index in Figure 3 and Figure 4 exclude cancelled events.

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

Sr. Communications & Content Manager

+1 (972) 687-9226

mtucker@ceir.org