Exhibition Industry Remains at a Standstill

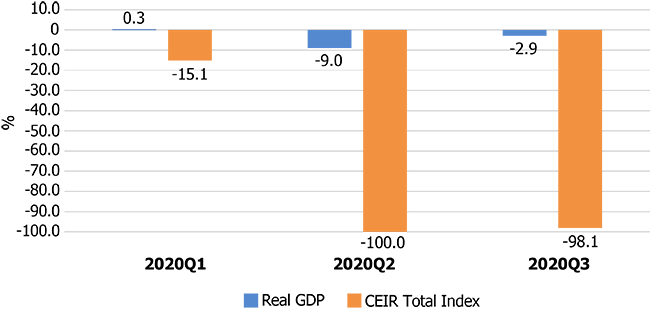

DALLAS, 18 December 2020 – The Center for Exhibition Industry Research (CEIR) reports that the exhibition industry remained at a grinding halt in the third quarter of 2020, with approximately 97% of originally scheduled events cancelled. As a result, the CEIR Total Index, a measure of exhibition industry performance, registered a 98.1% decline from a year ago (see Figure 1). The industry experienced a more moderate year-over-year decline of real (inflation-adjusted) GDP at 2.9%, which increased at an annual rate of 33.1% from the previous quarter. The latter had been somewhat boosted by continued reopening of businesses, strong residential investment, and online and other consumer goods purchases.

Figure 1: Real GDP vs. CEIR Total Index, 2020 Q1-Q3, Year-over-Year % Change

Despite the economic rebound enjoyed in the third quarter, the exhibition industry remained largely stalled given the persistence of COVID-19. A second wave of the virus in July prompted a number of states to pull back on reopening their economies and impose stringent group size limitations, all contributing to a lack of trade show activity. About 3% of events did take place as mostly small, regional events. The continuance of stringent rules imposed by states and municipalities, as well as ongoing no travel corporate policies, caused most events scheduled for the third quarter to be canceled or postponed to 2021. These two reasons are cited as the top two reasons why business-to-business (B2B) exhibition organizers say they were forced to cancel, according to CEIR’s June poll. These policies mute participation potential. Other opinion polls tracking consumer sentiment record reluctance to travel, with air travel continuing to remain well below 2019 levels.

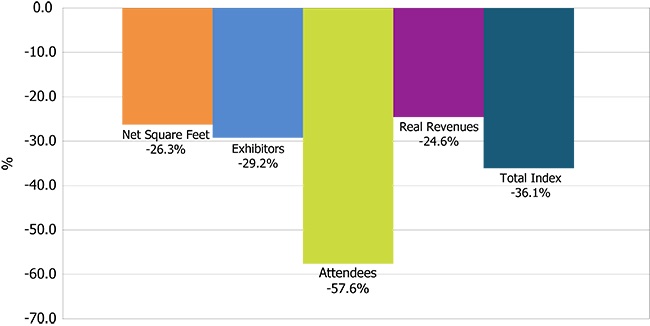

Excluding the cancelled events during the third quarter, the Total Index dropped by 36.1%. All exhibition metrics posted sharp year-over-year declines. Attendees suffered the largest fall of 57.6% and exhibitors decreased 29.2%, whereas net square feet (NSF) tumbled 26.3%. Real revenues declined 24.6% from a year ago.

Figure 2: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2020Q3

The U.S. economy has been growing since May. With a sharp rebound in the third quarter, the real GDP was only 3.5% below its peak in the fourth quarter of 2019. Recent monthly economic indicators point to continued moderate growth in the fourth quarter, though newly imposed restrictions in some states will restrain recovery around the turn of the year. As a result of Congress failing to quickly pass a Phase 4 rescue plan combined with a relatively high rate of new COVID-19 cases, economic growth in the first quarter of 2021 is likely to slow significantly. Nonetheless, CEIR expects economic growth will accelerate again in the second quarter as more people are vaccinated and the impact of the Phase 4 rescue programs start to kick in. CEIR expects real GDP to surpass its previous peak in the third quarter of 2021.

“The strong underlying macroeconomic factors should lay a firm foundation of support to the B2B exhibition industry when state and local governments ease restrictions on group gatherings during the second half of 2021,” said CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc.

“The exhibition industry is transforming and innovating itself with a rise in virtual or hybrid events to fill the void while physical events are paused,” added CEIR CEO Cathy Breden, CMP, CAE, CEM. “With a full recovery in the economy and a majority of the population vaccinated, the recovery of B2B exhibitions should take hold in 2022.”

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

+1(972) 687-9226

mtucker@ceir.org