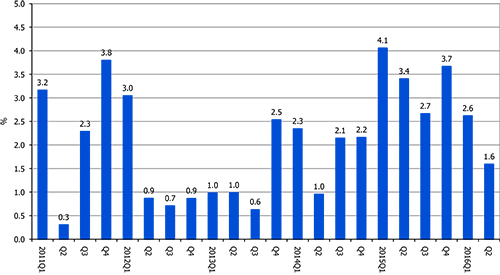

The Center for Exhibition Industry Research (CEIR) has released CEIR Index results for this year’s second quarter. Reflecting a sluggish macro economy and declining corporate profits, growth for the business-to-business exhibition industry during the second quarter of 2016 has slowed. The industry’s performance, as measured by the CEIR Total Index, posted a modest year-on-year gain of 1.6% in 2016Q2 (see Figure 1), compared to 3.7% in the fourth quarter of 2015 and 2.6% in the first quarter of 2016.

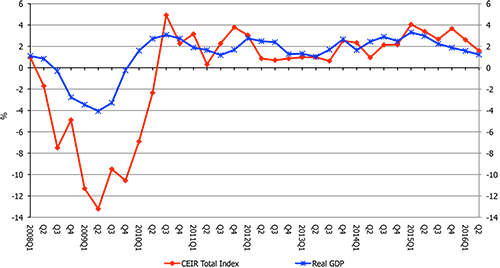

The moderation in growth was attributable to a small decline in attendees. Nonetheless, 2016Q2 marked the 24th consecutive quarter of year-on-year growth. Furthermore, the industry has continued to outperform the macro economy for six quarters straight (see Figure 2).

Figure 1: Quarterly CEIR Total Index for the Overall Exhibition Industry, Year-on-Year Growth, 2011Q1-2016Q2

Figure 2: Quarterly CEIR Total Index for the Overall Exhibition Industry Vs. Quarterly Real GDP, Year-on-Year Growth, 2008Q1-2016Q2

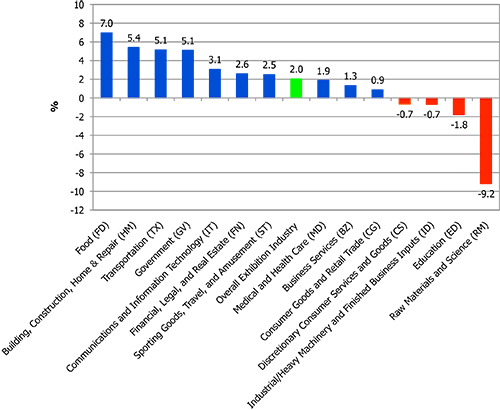

The strong year-on-year growth in Sporting Goods, Travel and Amusement, Food, and Transportation sectors more than offset the weakness in Raw Materials and Science, and Education sectors.

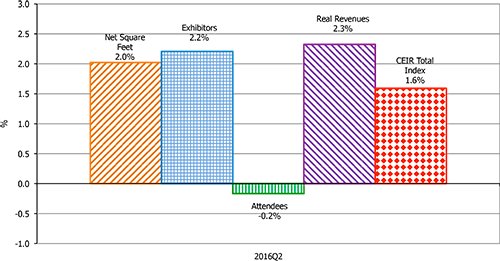

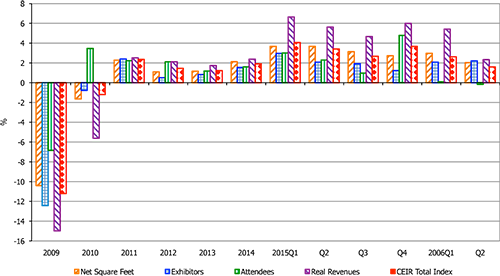

All exhibition metrics in 2016Q2 except attendees posted moderate year-on-year gains of slightly over 2%. As was the case during 2015 and the first quarter of 2016, the strongest metric was real revenues (nominal revenues adjusted for inflation), which rose 2.3%. It was followed by exhibitors, which increased by 2.2%. Net square feet increased 2.0%, whereas attendees posted a small decline of 0.2% (see Figures 3 and 4), which was attributable to a substantial decline of 20.4% in Raw Materials and Science exhibition attendees. The plunge in oil prices took a toll on oil-related exhibitions. If the number of attendees for Raw Materials and Science exhibitions had stayed the same as a year ago, the growth of attendees for the overall exhibition would have been 2.4%, which would have pushed the Total Index to 2.2%.

Figure 3: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-on-Year Growth, 2016Q2

Figure 4: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-on-Year Growth, 2009-2016Q2

“The slower growth in the second quarter is a temporary setback,” noted CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc. “As oil prices stabilize and consumer spending continues to remain the main driving force, by 2017 macroeconomic growth and subsequently the business exhibition industry will pick up the pace.”

For the first half of 2016, the Total Index rose 2.0%. Among 14 industry sectors, 10 sectors enjoyed year-on-year gains whereas four sectors suffered year-on-year declines. So far in 2016, the leading sectors have been Food (7.1%); Building, Construction, Home & Repair (5.4%); Transportation (5.1%); and Government (5.1%). Declining sectors were Raw Materials and Science (-9.2%); Education and Nonprofit (-1.8%); Industrial/Heavy Machinery and Finished Business Inputs (-0.7%); and Discretionary Consumer Services and Goods (-0.7%).

Early this year, we had a pessimistic outlook for Education and Government exhibitions as tight budgets and sluggish government employment were expected to shrink the potential attendee lists for exhibitions that catered to government services, especially military applications. Education experienced a decline as expected. However, the Government sector has grown at a respectable pace so far this year. After several down years, the expansion of Government exhibitions may reflect some pent-up demand by various government agencies to retool their organizations. Stronger than expected gains in the Government sector provides an unexpected boost to the overall performance of the exhibition industry.

Figure 5: CEIR Overall Index by Sector, Year-on-Year % Change, 2016H1

“We are seeing the direct impact the overall economy has on our industry and yet we are still quite positive about the near future outlook,” said CEIR President & CEO Brian Casey, CEM. “Clearly this data can be highly useful to many organizations as they look at strategic plans as well as reporting to their leadership. At CEIR Predict we will be taking an in-depth look at a number of these future trends and offer insights into effective solutions for industry executives to implement.”

Predict: CEIR’s Annual Outlook Conference will be held 14-15 September 2016 at the Ronald Reagan Building and International Trade Center in Washington, D.C. The event provides an outlook on the global economy and the exhibition industry’s performance.

About CEIR

CEIR provides industry-leading research on the North American exhibitions and events industry globally which optimizes performance, increases engagement and addresses emerging customer needs. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

+1 (972) 687-9226

mtucker@ceir.org