Strong Rebound of US B2B Exhibition Industry Continues

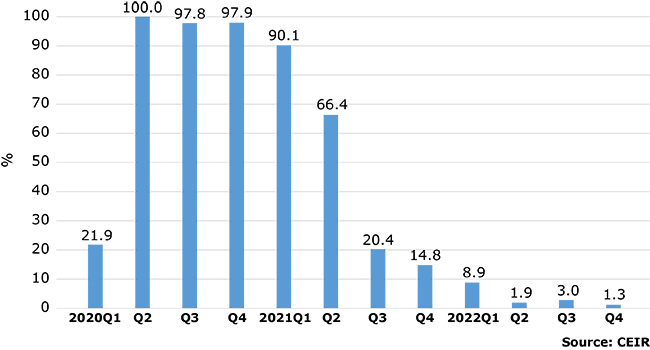

DALLAS, 30 March 2023 – The Center for Exhibition Industry Research (CEIR) announced today that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording a continued improvement in Q4 2022 from the previous 11 quarters. The cancellation rate for physical in-person events dropped to 1.3%, which is a substantial improvement from 97.9% in Q4 2020 and 14.8% in Q4 2021.

Figure 1: B2B Exhibition Industry Cancellation Rate, %

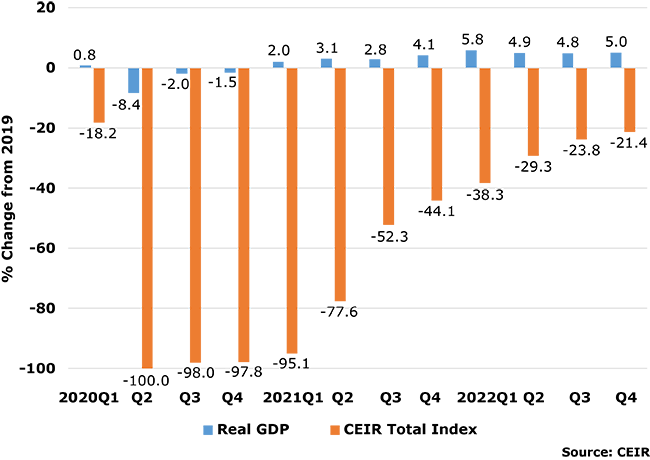

A relatively low cancellation rate and continued improvement in metrics outcomes for completed events boosted the Q4 2022 Index result. As expected, the CEIR Total Index – a measure of overall exhibition performance – continues to recover, surging 40.6% from a year ago. Compared to Q4 2019, it was still 21.4% lower as shown in Figure 2 below. Nonetheless, this is a vast improvement compared to the past two years, which included declines of 97.8% from 2019 in Q4 2020 and 44.1% from 2019 in Q4 2021.

U.S. GDP and the CEIR Total Index

The performance of the U.S. economy was far better, registering a 5.0% increase in real (inflation-adjusted) GDP from Q4 2019 to Q4 2022. On a seasonally-adjusted annual rate (SAAR) basis, after two consecutive quarters of decline in Q1 and Q2, real GDP rose at a moderate rate, gaining 3.2% in Q3 and 2.6% in Q4. The rebound in Q4 primarily reflected increases in private inventory investment, consumer spending, nonresidential fixed investment, government spending at all levels and declines in imports that were partly offset by decreases in residential fixed investment and exports.

Up to Q4 2021, economic recovery had been led by strong spending on goods. However, the initially sluggish recovery in services industries recently has continued to pick up the pace. In Q3 2021, real spending on consumer services finally recovered pandemic losses and robust expansion has continued since then. In Q4 2022, real spending on consumer services exceeded Q4 2019 spending levels by 4.2%.

Figure 2: Real GDP vs. CEIR Total Index, Q1 2020-Q4 2022, % Change from 2019

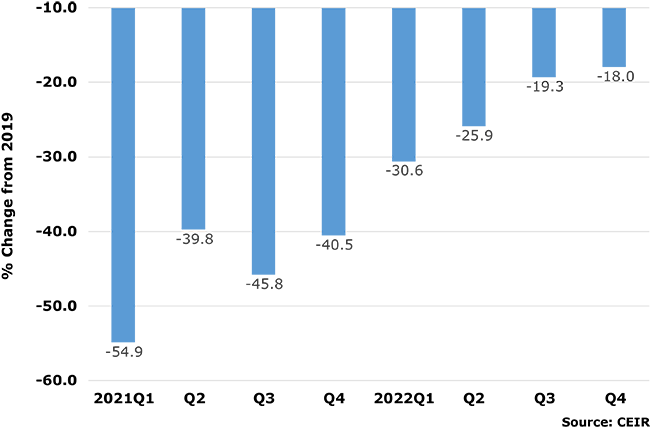

Q4 2022 Exhibition Industry Performance

Figure 3 provides insights about events completed during Q1 2021 to Q4 2022, comparing performance of each to the same quarter in 2019. Q4 2022 results speak to a continuing but choppy and uneven recovery that is underway. Still, the direction is positive, with the overall Index and specific metrics improving for the past seven quarters. Among completed events, 23.6% have surpassed their pre-pandemic levels of the CEIR Total Index. Some organizers launched new shows, expanded existing shows to new locations or held them at a different time of the year. When looking at results excluding cancellations, performance of events that happened in Q4 2022 documents continued improvement; it is down only 18% compared to 2019 (Figure 3), which is much better than the decline of 54.9% registered in Q1 2021 compared to 2019.

Figure 3: CEIR Total Index Excluding Cancellations, % Change from 2019

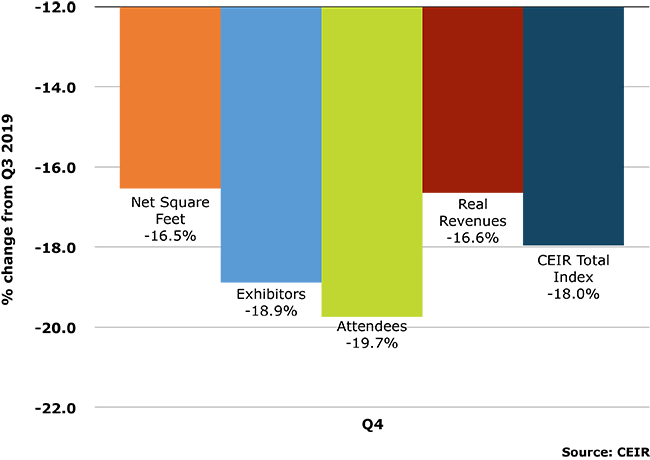

Among the four metrics, Attendees has recovered the least, still 19.7% below results registered in Q4 2019; followed by Exhibitors with a decline of 18.9%. Real Revenues is 16.6% below Q4 2019. Net Square Feet (NSF) in Q4 was the metric that contracted the least at 16.5% from Q4 2019.

Figure 4: Q4 2022 CEIR Metrics for the Overall Exhibition Industry Excluding Cancellations, % Change from Q4 2019

Insights on a Recession

The probability of a recession in 2023 stood at about 50% and now is slightly higher at 55% since the failures of Silicon Valley Bank and Signature Bank of New York. The potential causes of recession include tighter financial and credit conditions, a self-fulling prophecy and some unknown and unpredictable shocks. Businesses that anticipate a recession ahead are cutting back their expenses and head counts. However, if there is recession, it likely will be shallow as: (1) household debt service payments as a percent of disposable income remains low even though it has inched up recently, (2) there is a pent-up consumer demand for services such as travel and tourism, (3) most large corporations still are flush with cash and (4) there is a race to adopt new technologies such as AI (artificial intelligence) and EV (electric vehicles).

B2B Exhibitions Recovery

2023 will be challenging for the exhibition industry as the economy slows down further and businesses are more cautious. Nonetheless, “the positive momentum of participation in face-to-face trade shows will continue. The B2B exhibition cancellation rate should remain extremely low, and the performance of completed events will continue to improve,” said CEIR Economist Dr. Allen Shaw, Chief Economist for Global Economic Consulting Associates, Inc. “A full recovery for the industry is expected in 2024.” Among 14 industry sectors that CEIR monitors, Government and Discretionary Consumer Goods and Services sectors are expected to perform better, whereas IT and Building and Construction sectors will lag behind the overall exhibition industry.

“Despite Omicron at the outset of 2022, CEIR research has documented an intent to return to face-to-face engagement at B2B exhibitions, and CEIR Index quarterly results continue to document the recovery is in progress,” added CEIR CEO Cathy Breden, CMP-F, CAE, CEM. “Each quarter, the Index is showing that more business professionals and exhibitors are coming back to the B2B exhibitions channel to meet their marketing, sales and business information needs.”

CEIR expects to release the 2023 CEIR Index Report in late May, which analyzes the 2022 exhibition industry performance and provides an economic and exhibition industry outlook for the next three years. CEIR collects data directly from B2B exhibition organizers, who are encouraged to provide their show data by using the Event Performance Analyzer. In exchange for submitting data for a valid B2B exhibition, the participants are provided this tool which enables an organizer to instantly see how an event’s performance compares to CEIR Index benchmarks at no cost. Data submission is strictly confidential. Click here for more information. The annual CEIR Index Report for their shows’ market sector will also be provided to participating organizers at no cost.

Explanation and Definitions of Q4 Comparisons

As explained above, 14.8% of trade shows scheduled to be held in the fourth quarter of 2021 were cancelled, limiting the usefulness of comparisons of Q4 2021 and Q4 2022 results, as any positive change would be very large and misleading. A more useful comparison is to the 2019 performance results, measured as the industry benchmark before COVID-19 forced the shutdown. Thus, events in the fourth quarter of 2022 are compared with those in the fourth quarter of 2019 in Figures 2-4. The CEIR Total Index in Figure 2 is a weighted average that includes both cancelled events, with zero values for all exhibition metrics, and completed events. The Total Index in Figure 3 and Figure 4 exclude cancelled events.

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

Sr. PR/Communications Manager

+1 (972) 687-9226

mtucker@ceir.org