B2B Exhibition Industry Ended 2020 at a Standstill though 2021 Looks Brighter

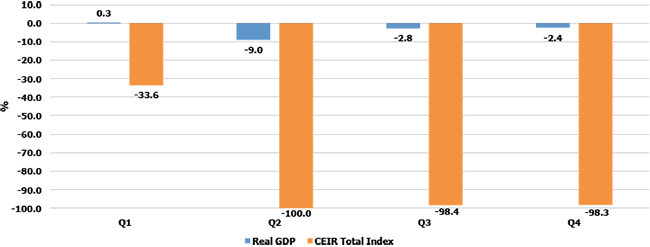

DALLAS, 17 March 2021 – The Center for Exhibition Industry Research (CEIR) reports that the U.S. business-to-business (B2B) exhibition industry in the fourth quarter remained at a grinding halt, with all but about three percent of events originally scheduled in the fourth quarter cancelled. As a result of many cancellations, the CEIR Total Index, a measure of exhibition industry performance, registered a 98.3% decline from a year ago (see Figure 1). The impact on the U.S. economy was far more moderate, registering a 2.4% year-over-year decline of real (inflation-adjusted) GDP. It increased at an annual rate of 4.1% from the previous quarter. GDP had been somewhat boosted by continued reopening of businesses, strong residential investment, and online and other consumer goods purchases.

Figure 1: Real GDP vs. CEIR Total Index, 2020 Q1-Q4, Year-over-Year % Change

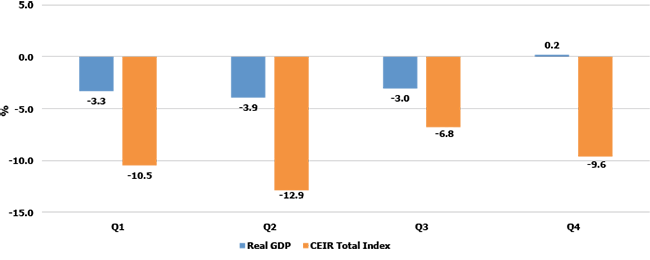

Despite the gradual economic recovery seen in the fourth quarter, the exhibition industry remained largely stalled given the persistence of COVID-19 which had a continued, devastating impact on group meetings. A third wave of the virus after Labor Day prompted a number of states to pull back on reopening their economies and impose stringent group size limitations, all contributing to lack of trade show activity. As a result, the decline in the Total Index as compared to GDP is far worse than was seen in 2009, the darkest period of the Great Recession (see Figure 2). About three percent of events did take place, mostly small, regional events. The continuance of stringent rules imposed by states and municipalities, as well as ongoing no-travel corporate policies, caused most events scheduled for the fourth quarter to be canceled or postponed to 2021 or later. These are cited as the top two reasons why B2B exhibition organizers say they were forced to cancel, according to CEIR’s June 2020 poll. These policies mute participation potential. Other opinion polls tracking consumer sentiment in 2020 recorded reluctance to travel, with air travel rates well below 2019 levels.

Figure 2: Real GDP vs. CEIR Total Index, 2009 Q1-Q4, Year-over-Year % Change

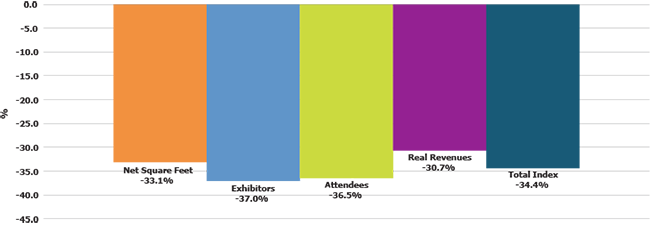

Excluding the cancelled events during the fourth quarter, the Total Index dropped by 34.4%. All exhibition metrics posted sharp year-over-year declines, as shown in Figure 3. Exhibitors suffered the largest fall of 37.0%, followed by attendees plunging by 36.5%. Net Square Feet (NSF) decreased 33.1% whereas Real Revenues tumbled 30.7% from a year ago.

Figure 3: Quarterly CEIR Metrics for the Overall Exhibition Industry Excluding Cancellations, Year-over-Year Growth, 2020Q4

Exhibitions held prior to the lockdowns, which started 15 March 2020, prevented a total loss for the year. Nonetheless, for the year as a whole, the Total Index in 2020 plunged 78.8% from a year ago. Excluding cancellations, the Total Index was flat, declining a modest 0.2%.

The U.S. economy has been growing since May 2020. With a sharp rebound in the third quarter and a continued recovery in the fourth quarter, real GDP in Q4 2020 was only 2.4% below its peak in the fourth quarter of 2019. For the year, GDP contracted a modest -3.5%.

Recent monthly economic indicators point to robust growth in the first quarter of 2021, fueled by surges in personal consumption expenditures, residential construction and other business investment. Economic activity will accelerate in the second quarter as more people are vaccinated and the impact of the $1.9 trillion COVID relief package starts to kick in. CEIR expects real GDP to surpass its previous peak by mid-year.

“The strong underlying macroeconomic factors should lay a firm foundation of support to the B2B exhibition industry when state and local governments ease restrictions on group gatherings during the second half of 2021,” said CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc.

The Biden Administration sets 31 May as its target for having enough supply to cover the entire adult population. On 11 March, President Biden directed states and other jurisdictions to make all adults eligible by 1 May. He envisioned a semblance of normalcy by July 4th.

Other indicators are also pointing to a more positive outlook that bodes well for the trade show industry. TSA check point numbers are improving significantly. The seven-day average ending 14 March jumped nearly 75% from early February, though still down by 51% compared to the seven-day average ending 14 March 2019. Also, according to Arriva list tracking of actual driving trends, driving habits have rebounded to pre-COVID levels, with the percentage of trips of 50 miles or more up 6.9% year-over-year for the period of 7 to 13 March. Recent research also indicates consumer’s sentiments are changing for the better. More will be ready to travel for business purposes once they are vaccinated. The majority (79%) of Global Business Travel Association (GBTA) members and stakeholders say they would be comfortable traveling for business after receiving the COVID-19 vaccination.

“With more states eliminating or easing restrictions on large gatherings, the exhibition industry is finally close to the end of tunnel,” said CEIR CEO Cathy Breden, CMP, CAE, CEM. “As the economy enters into an expansion phase and with a majority of the population vaccinated, the recovery of B2B exhibitions should begin by the end of this year and gain momentum in 2022.”

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

Sr. PR/Communications Manager

+1 (972) 687-9226

mtucker@ceir.org