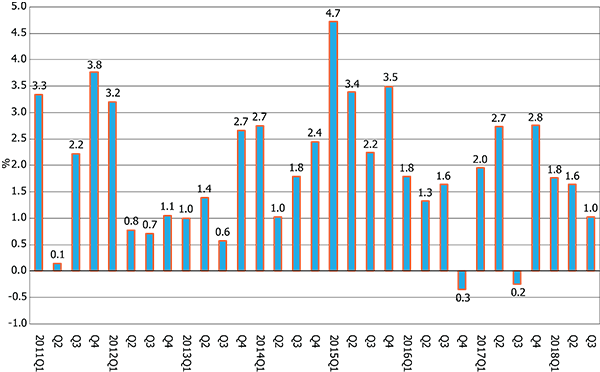

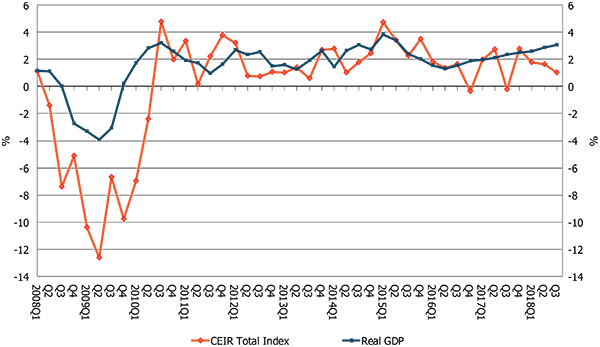

The Center for Exhibition Industry Research (CEIR) reports that the recent growth of the exhibition industry continued during the third quarter of 2018. The performance of the industry, as measured by the CEIR Total Index, posted a modest year-over-year gain of 1.0% (see Figure 1), even though it underperformed the macroeconomy (see Figure 2). While the performance during the third quarter was weaker than the first two quarters of the year, it was a significant improvement over the same quarter in 2017 when it registered a year-over-year decline of 0.2%.

Figure 1: Quarterly CEIR Total Index for the Overall Exhibition Industry, Year-over-Year Growth, 2011Q1-2018Q3

Figure 2: Quarterly CEIR Total Index for the Overall Exhibition Industry vs. Quarterly Real GDP, Year-over-Year Growth, 2008Q1-2018Q3

“The growth of the exhibition industry should pick up the pace during the fourth quarter of the year and, at least, through the first half of next year as the economy remains strong despite uncertainties surrounding the trade negotiation with China, volatile stock market and slowing world economic growth,” said CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc.

Discretionary Consumer Goods and Services; Government; and Medical and Health Care all registered robust year-over-year gains. In contrast, Business Services; Consumer Goods and Retail Trade; and Education posted year-over-year declines.

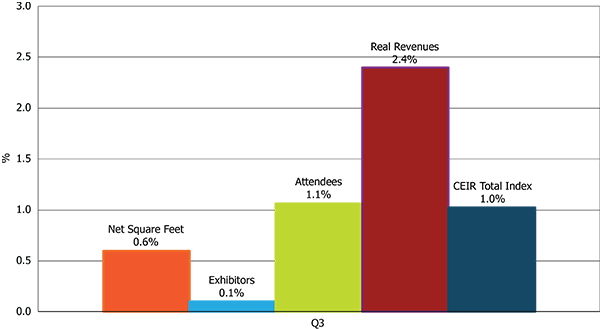

All exhibition metrics in the third quarter posted positive year-over-year gains (Figures 3 and 4). Real revenues (nominal revenues adjusted for inflation) and attendees posted the largest increase of 2.4% and 1.1%, respectively, followed by net square feet (NSF) which rose 0.6%, whereas exhibitors gained 0.1%.

Several industries have been in a secular decline including Business Services; Consumer Goods and Retail Trade; Education; and Financial, Legal and Real Estate sectors. “Anemic growth in the number of exhibitors is in part attributable to secular downward trends evidenced in these sectors,” said CEIR CEO Cathy Breden, CMP, CAE. “Barring any other negative downward trends in the economy, and until these sectors stabilize, the overall growth for the industry will remain modest.”

Figure 3: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2018Q3

Figure 4: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2009-2018Q3

The CEIR Event Performance Analyzer provides exhibition organizers with a tool to measure how an event is performing in its sector, as well as in the overall industry. The CEIR Index Report provides an economic overview of the exhibition industry, including key indicators for growth. Together, these resources provide insights for developing business strategies and goals.

The annual CEIR Predict Conference, scheduled for 16-17 September 2019 at the MGM National Harbor, outside of Washington, D.C., will provide exhibition professionals with macroeconomic insights and help attendees understand the economic and political factors impacting the exhibition industry.

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

###

Media Inquiries:

Mary Tucker

+1(972) 687-9226

mtucker@ceir.org